Lumotive, a startup specializing in programmable optics, has secured additional strategic investors for its recent Series B funding round.

The Redmond, Washington-based company reopened its Series B round to include Amazon, via its Amazon Industrial Innovation Fund, and ITHCA Group, the tech investment division of Oman’s sovereign wealth fund.

These new investments have increased the company’s Series B round to $59 million, an increase from the $45 million initially secured in February. The startup’s total venture capital raised now exceeds $100 million.

Lumotive CEO Sam Heidari indicated that investor demand for the round surpassed initial expectations. Although some investors were initially declined, reopening the round for ITHCA Group and Amazon was deemed beneficial.

Heidari stated that Amazon offers significant strategic value, emphasizing that the relationship is valued more than the financial contribution.

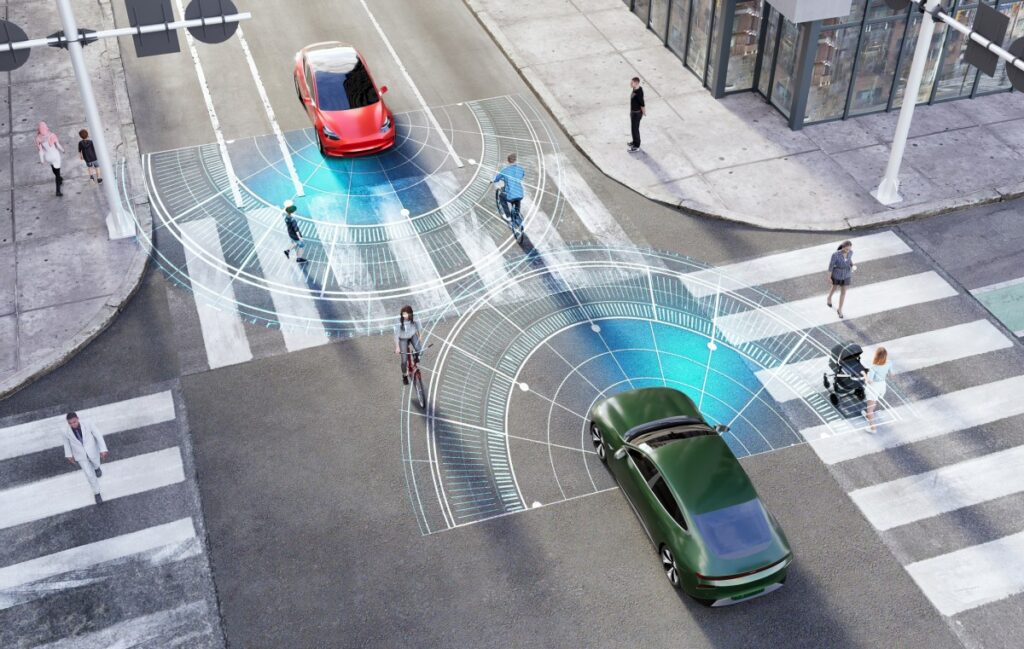

Lumotive’s Light Control Metasurface solid-state chips utilize nano-scale pixels that are electronically controlled to bend and manipulate light. These chips are applicable in various fields, such as autonomous vehicles for environmental sensing, providing a more compact and economical alternative to mechanical lidar, and for optical switching in data centers.

Heidari described the technology as a “paradigm shift” in electronically manipulating light. This includes shaping, steering, forming beams, and focusing light electronically, essentially replicating the functions of mirrors and motors in light control.

Established in 2018, the company began selling its chips in 2024, maintaining a deliberately small and focused customer base. Heidari indicated that the new capital will support expanded sales and marketing efforts, alongside increased investment in research and development.

Heidari commented on Lumotive’s technology, stating it is “not a science project anymore” but a “proven technology in the field.” He added that there is significant demand, and the technology is not only functional but also deployable.